These are reported in the notes to the financial statements (instead of a general ledger account) because the amount might not be determinable or the liability is possible but not probable. Likewise, AK Steel has given complete information regarding its operating leases. Instead, the company records it in the annual financial statement or 10-k reports’ footnotes.

- Therefore, the company hasn’t included the potential loss liability in its balance sheet.

- A potential gain contingency can be recorded and disclosed in the notes to the financial statements.

- Commitments are likely legal binding agreements for future transactions.

- Recognized contingencies, such as probable legal liabilities, appear as liabilities on the balance sheet, directly impacting the company’s financial position.

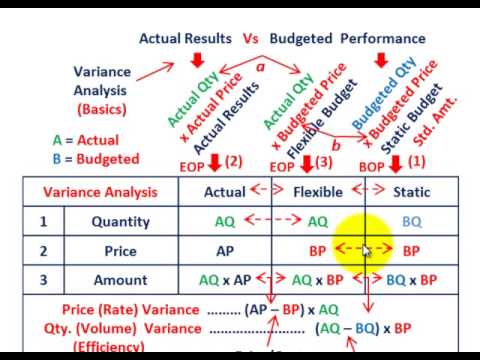

In loss contingencies, losses are reported when they become probable, whereas, in gain contingencies, the gain is delayed until they occur. The following example better illustrates the gain contingencies. Companies will often have some contingent liabilities, which are not recorded in the general ledger because the liability and loss may or may not become a liability. Unless the commitments and contingencies liability/loss is remote, if the item is signicant, it must be disclosed. We do not include any amount in the income statement in gain contingencies until a substantial completion is reached. In this case, the gain contingencies are $270,000, which company A reports in its income statement at the end of year three.

Contingencies, on the other hand, require a more nuanced approach due to their inherent uncertainty. Organizations must evaluate the likelihood of contingent events occurring and estimate the potential financial impact. This involves a combination of legal, environmental, and operational assessments to determine the probability and magnitude of potential liabilities or gains.

Gain Contingencies

In addition, the revelations drive the organization with legal and monetary reporting needs. Assuming a company incurs a contingency at the end of year one. The company believes that a loss of $300,000 is probable, but a loss of $390,000 is reasonably possible.

Optimization of Capital Structure: An Important Financial Decision

In the realm of financial management, commitments are prearranged obligations that a company agrees to fulfill in the future. These commitments can take various forms, each with distinct implications for an organization’s financial planning and reporting. Commitments represent binding agreements that will result in future outflows of resources, while contingencies involve uncertain conditions that may lead to gains or losses depending on the outcome of specific events. Yet, the reporting of gain contingencies is different from that of loss contingencies.

Search within this section

Although AK Steel has agreed, it has not recorded the amount in the balance sheet in 2016 because it hasn’t yet incurred the investment. Still, it has given a note in the financial statement, as shown below in the snapshot. However, it is not necessary to provide in detail one-to-one relationship with the amount of borrowing and its utilization. Rather, disclosure should be made in a manner to give an overall position of the balance sheet at the reporting period. These are not recorded on the balance sheet as they are uncertain, yet they can significantly impact a company’s financial standing.

These agreements or contracts may include the following items. Contingencies, per the IFRS, are expected to be recorded and disclosed in the notes of the financial statement accounts, regardless of whether they result in an inflow or outflow of funds for the business. As with all organizations, an entity is obliged to fulfill contracts and obligations to ensure operational longevity. Obligations and contracts are considered commitments for an entity that could result in a cash (or funds) inflow or outflow, regardless of other operations or events. The finance term “Commitments and Contingencies” is important because it incorporates potential obligations that a company may incur depending on varying outcomes of future events. The disclosure and acknowledgment of commitments and contingencies provide comprehensive organizational clarity and increase suitable stakeholders’ trust.

Why does commitment and contingencies appear on the balance sheet without an amount?

The line generally appears between the liabilities and stockholders’ equity sections to direct a reader’s attention to the disclosures included in the notes to the financial statements. PwC refers to the US member firm or one of its subsidiaries or affiliates, and may sometimes refer to the PwC network. This content is for general information purposes only, and should not be used as a substitute for consultation with professional advisors.

- According to these guidelines, contingencies that are probable and can be reasonably estimated must be recognized as liabilities in the financial statements.

- However, the likelihood of loss or the actual loss both remains uncertain.

- Facebook has also entered into non-cancelable contractual payment commitments of $1.24 billion related to network infrastructure and data center operations.

- Contingencies, per the IFRS, are expected to be recorded and disclosed in the notes of the financial statement accounts, regardless of whether they result in an inflow or outflow of funds for the business.

- Led by editor-in-chief, Kimberly Zhang, our editorial staff works hard to make each piece of content is to the highest standards.

- However, if the company hasn’t made any payment for such contracts at the balance sheet date, they are not included on the balance sheet, although they are still considered liabilities.

Commitments and contingencies represent future events that carry financial risk for a company. Revealing these items provide valuable information to investors, creditors, and other stakeholders about the company’s future obligations and potential risks that could impact the financial position of the company. Commitments and contingencies are not typically recorded as liabilities on a company’s balance sheet. Instead, they are disclosed in the notes or footnotes to the company’s financial statements, unless their likelihood is determined to be probable and the amount can be reasonably estimated.

Contingencies are not guaranteed, and they heavily rely on the occurrence or lack thereof, of uncertain future events. The books of accounts do not recognise contingent liabilities. Moreover, disclosures related to various commitments such as Capital Commitments, other commitments and uncalled liability of shares have been made necessary under Ind AS Schedule III. A commitment refers to the company’s obligation to carry out a certain action in the future, typically due to contractual agreements. On the other hand, contingencies are potential liabilities that will only occur given a certain set of circumstances or events in the future.

For example, a disclosed environmental contingency might alert stakeholders to future compliance costs, influencing their assessment of the company’s long-term sustainability. Legal contingencies arise from potential legal actions or disputes that could result in financial liabilities. For instance, a pharmaceutical company might face litigation over alleged side effects of a drug, which could lead to substantial financial settlements if the court rules against the company. Organizations must assess the likelihood of these outcomes and estimate the potential financial impact. According to the Financial Accounting Standards Board (FASB) guidelines, companies are required to disclose legal contingencies in their financial statements if the loss is probable and can be reasonably estimated.

However, if the amount can be estimated and there is a high probability of occurrence of the loss, then it can be recorded in the financial statements. On the other hand, contingencies represent uncertain situations that could lead to an economic gain or loss hinging on a future event, such as a pending lawsuit, potential warranty claims, or even insurance recoveries. In case the entity is not able to meet the commitment, it should justify its action by disclosing the same again as notes in the financial statements stating the details about the type of commitment, its time, cause, etc.

This disclosure includes items like the length of the lease and expected yearly payments coupled with minimum lease payments over the entire term of the lease. The graph below illustrates AK Steel’s operating lease payments for the lease period. The Financial Accounting Standards Board (FASB) provides guidelines for accounting for contingencies, emphasizing the need for transparency and consistency.

Treatment of Commitments and Contingencies as per IFRS

For example, legal contingencies necessitate consultations with legal counsel to gauge the likelihood of unfavorable outcomes and the potential financial repercussions. These assessments are crucial for determining whether contingencies should be recognized as liabilities on the balance sheet or merely disclosed in the notes. Accurately accounting for commitments and contingencies is fundamental to presenting a true and fair view of an organization’s financial health.

Per accounting principles and standards, gains acquired by an entity are only recorded and recognized in the accounting period that they occur in. The disclosure requirements of commitments comprise the category, amounts, and any not standard terms and commitment uncertainties. A contingency displays a situation concerning a probable loss that may eventually be fixed if one or more future events happen or do not occur. As you have seen in the above snapshot, AK Steel has given an extensive explanation regarding its future commitments or obligation in the notes of the financial statement.

For instance, a manufacturing firm might commit to building a new factory, which involves significant capital expenditure over several years. Such commitments are typically disclosed in the financial statements to provide stakeholders with a clear picture of future cash outflows and the company’s growth trajectory. Understanding capital commitments is essential for assessing a company’s future financial health and its ability to generate returns on these investments. Purchase obligations are commitments to buy goods or services at predetermined prices and quantities in the future. These are common in industries with complex supply chains, such as automotive or electronics manufacturing.

Thus, these contracts are considered future obligations that do not necessarily qualify as liabilities. At the same time, contingencies are considered potential liabilities that might occur due to past events. However, the likelihood of loss or the actual loss both remains uncertain. GAAP – As per the GAAP, the recording of commitments in the books of accounts are done as and when they happen. But contingencies are recorded or disclosed as notes in the balance sheet while creating the financial statements, provided they relate to some cash outflow in the future or any similar liability.